Carbon Credits and Opportunities in Vietnam

The trading of carbon credits provides companies with both environmental and financial benefits, facilitating the reduction of emissions whilst the same time the generation and selling of carbon credits (or transferring unused quotas) creates new revenue streams for enterprises. Participation also enhances ESG performance, improves access to green financing, and strengthens competitiveness. For early movers, especially in emerging markets like Vietnam, it is a timely opportunity to turn climate action into economic value.

Aligned with global sustainability goals, Vietnam is committed to achieving net-zero emissions by 2050 and is actively developing its domestic carbon market under Decree No. 06/2022/NĐ-CP and Decision No. 232/QD-TTg, with a national exchange expected in operation by 2029. Carbon markets operate under two models: compliance markets, governed by UNFCCC commitments, and voluntary markets, driven by cooperative agreements to meet ESG objectives.

Below we have outlined an overview of Vietnam’s carbon credit market from the evolving legal framework to assist foreign investors better understand the market’s potential and prepare for effective and sustainable project implementation.

1. Vietnam’s Carbon Credit Exchange

According to Law on Environmental Protection 2020, a “Carbon Credit” is a tradable certificate representing the right to emit one tonne of CO2 or one tonne of CO2 equivalent. Carbon credits can be acquired through established carbon credit exchanges or via direct purchase agreements with certified project developers. Greenhouse gas emission quotas (“GHG Emission Quotas”), represent the allowable amount of GHG emissions that a country, organization, or individual is permitted to release within a specific period, measured in metric tonnes of CO2 or its equivalents. Accordingly, by June 2025, the allocation of GHG Emission Quotas and pilot implementation of the trading system will begin.

The Carbon Credit Exchange is a central hub for processing transactions for buying and selling carbon credits, GHG Emission Quotas, and auctioning, borrowing, paying back, and transferring GHG Emission Quotas.

Participants in the Carbon Credit Exchange will be varied, including (i) facilities in the list of sectors and facilities emitting greenhouse gases must inventory greenhouse gases issued by the Prime Minister (“Emitting Establishments”); (ii) organizations engaged in the carbon credit exchange and offset mechanism; and (iii) Organizations and individuals involved in the investment and trading of GHG Emission quotas and carbon credits.

The specific Emitting Establishments are listed in Decision 13/2024/QD-TTg and are to be updated every two (2) years.

The Carbon Credit Exchange allows the participants to manage their quotas and carbon credit through the following mechanisms:

- Participating in auctions to acquire additional GHG Emission Quotas beyond their initial allocation within the same commitment period;

- Transferring unused GHG Emission Quotas from the previous year to subsequent years within the same commitment period;

- Borrowing GHG Emission Quotas from the next year to use in the previous year within the same commitment period;

- Utilising Carbon Credits from projects under the carbon credit exchange and offset mechanisms to compensate for GHG emissions exceeding their allocated quotas within the same commitment period. However, this offset may not exceed 10% of the total GHG Emission Quotas allocated to these establishments.

If an Emission Establishment exceeds its allocated GHG Emission Quotas after trading, enterprises must pay for the excess and will have the overage deducted from its quotas in the next commitment period. Currently, no penalties are prescribed for non-compliance.

2. Carbon credit exchange and offset mechanism

The carbon credit exchange and offset mechanism refers to the processes for registering and implementing GHG emission reduction programs or projects, which generate carbon credits based on methodologies recognized either internationally or by Vietnam. Carbon credits from these programs or projects can be traded on the carbon market or used to offset greenhouse gas emissions that exceed allocated quotas.

How to generate carbon credits?

Carbon credits are primarily generated through projects that actively reduce GHG emission or enhance carbon sequestration. These typically include renewable energy initiatives, afforestation, and sustainable agricultural practices. To generate carbon credits, projects must demonstrate verifiable emission reductions and align with both domestic and international standards. Examples of carbon credit-generating projects include:

- Vietstar Urban Waste Treatment Project – Ho Chi Minh City: Project activities include sorting municipal waste; recycling plastic waste, aerobic thermal treatment of organic fraction, estimated to reduce emissions by about 181,492 tCO2e per year.

- Vietnam’s first nearshore wind power plant, located in Bac Lieu province, with a total capacity of 99.2 MW, is estimated to reduce emissions by about 143,761 tCO2 per year.

Certification of carbon credits

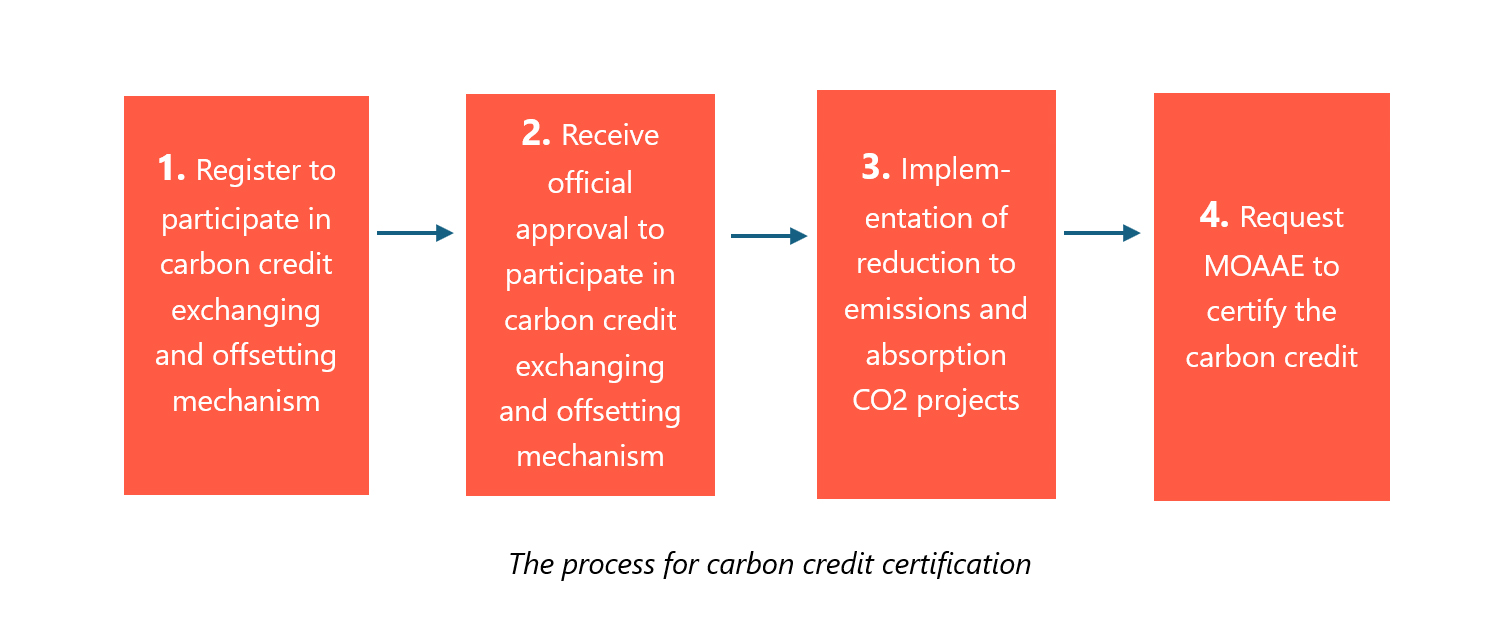

Under current regulations, the company implements domestic projects on reducing emissions and absorbing CO2 can obtain carbon credit for trading on the domestic carbon credit exchange through the following process:

Projects under the carbon credit exchange and offset mechanism must comply with the UNFCCC and other international treaties and agreements to which Vietnam is a party.

3. Opportunity for investors

Participation in the carbon market, which is fundamentally an economic mechanism for environmental protection, can support companies in achieving their sustainability goals, particularly in reducing GHG emissions and energy consumption. In Vietnam, GHG reduction projects are actively encouraged and supported through preferential policies and financial assistance from international organizations such as the World Bank and the United Nations Development Programme. These projects offer businesses the potential to generate new revenue streams through the sale of carbon credits. Additionally, companies in the manufacturing sector may benefit from trading GHG Emission Quotas.

To succeed in this evolving market, investors will need to gain a comprehensive understanding of how the carbon credit market operates, including relevant legal regulations, applicable standards, and certification procedures that align with their industry and business needs. As the domestic carbon exchange is anticipated to become operational by 2029, early preparation and entrance bring the opportunity to realize both environmental and economic benefits in a rapidly developing market.

For any further questions you may have, please reach out to us at vietnam@alitium.com

********

This article is intended to provide an overview of recent updates and announcement. While it aims to present useful insights, it is important to note that the content shared here should not be considered as formal legal or financial advice. For specific guidance on tax obligations or legal matters related to your business, we strongly recommend consulting with a qualified professional, such as a tax advisor or legal expert or directly reach out to us.