On 7 June 2024, the Ministry of Finance released a draft proposal to seek opinions on upcoming amendments to the Corporate Income Tax Law. The 32 page document covers significant details, and apart from various sections clarifying and cleaning up areas of the law that have evolved in recent years, a significant proposal includes the reduction in Corporate Income Tax (CIT) for certain taxpayer groups

Proposed reductions in Corporate Income Tax rates

The document proposes reductions in corporate income tax rates for smaller companies, as a method to promote small and medium businesses in Vietnam. The proposed reduced CIT rates are:

- Micro-sized enterprises, being companies with annual revenue less than VND 3 billion (approx. USD118,000) will be subject to a 15% CIT rate, and

- Small-sized enterprises, being companies with annual revenues between VND 3 billion and VND 50 billion (approx. USD 1.97 million) will be subject to a 17% CIT rate.

There are proposed provisions relating to grouping so that the revenue thresholds are tested in conjunction with affiliated companies (essentially, forming a tax group for these revenue threshold determinations).

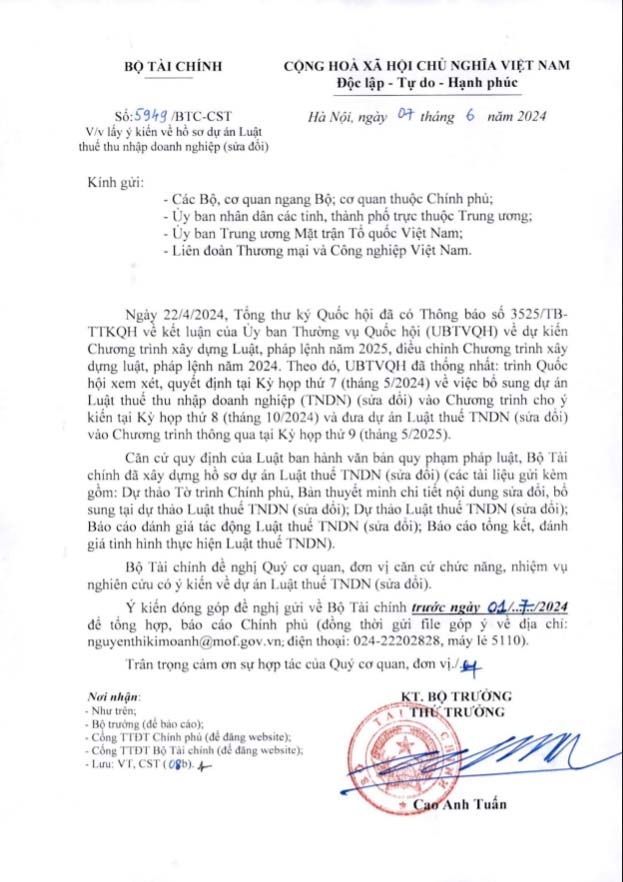

The period for comments on the draft proposal (5949/BTC-CST) are due by 1 July 2024 to the Ministry of Finance.

Phuong Vo is Managing Partner at Alitium Vietnam, providing market entry and professional support for foreign investors in Vietnam. Contact Phuong via Alitium.com for further assistance and advice.