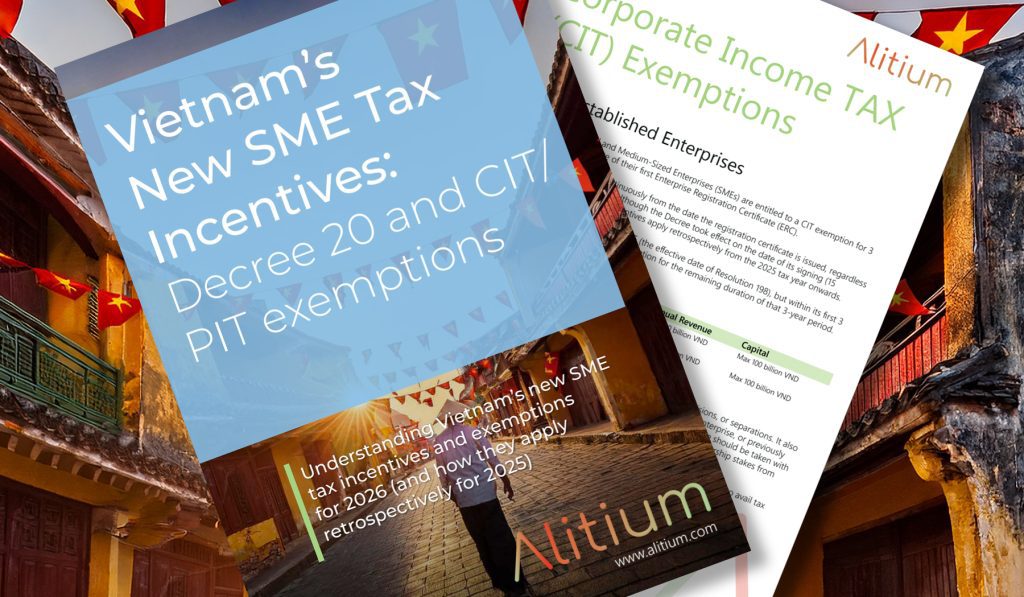

Decree 20/2026/ND-CP: Covering Tax Incentives and the Private Economic Sector, and Promoting Innovation and Startups

Corporate Income TAX (CIT) Exemptions

Newly Established Enterprises

Newly established Small and Medium-Sized Enterprises (SMEs) are entitled to a CIT exemption for 3 years starting from the date of their first Enterprise Registration Certificate (ERC).

The exemption period runs continuously from the date the registration certificate is issued, regardless of when revenue or profit arises. Although the Decree took effect on the date of its signing (15 January 2026), these specific tax incentives apply retrospectively from the 2025 tax year onwards.

Companies stablished before 17 May 2025 (the effective date of Resolution 198), but within its first 3 years of operations, can claim the CIT exemption for the remaining duration of that 3-year period.

Criteria for Classification as a SME:

Sector | Employees | Annual Revenue | Capital |

Agriculture, Industry, Construction | Max 200 people | Max 200 billion VND | OR Max 100 billion VND |

Commerce, Services | Max 100 people | Max 300 billion VND | OR Max 100 billion VND |

This incentive does not apply to new enterprises formed via mergers, divisions, or separations. It also provides certain exclusions for businesses where owners manage another enterprise, or previously managed another enterprise that was dissolved less than 12 months prior. Care should be taken with regards to Legal Representatives and their equity involvements, along with ownership stakes from founders, to ensure that the incentives can be accessed.

These anti-avoidance provisions are drafted to prohibit the creation of multiple entities to avail tax benefits that would otherwise not be accessible to companies.

Innovative Startups and Support Organisations

Organisations that meet the definition of a Innovative Startup or Support Organisation are entitled to a two‑year CIT exemption from their first year of taxable income (ie, taxable profit), followed by a further fours years with a 50% CIT reduction, in respect to their eligible activities. This exemption runs concurrently with the initial 3-year exemption for newly established businesses.

Requirements are:

• Operate innovation-driven business models (technology, IP, etc)

• Recognised as an innovative startup under both the SME and the existing science and innovation legal framework

• Income derived from qualifying innovation activities, with other income segregated from these incentives

• Intermediary Organisations Supporting Startups are those that support innovative enterprises and startups through services such as incubation, acceleration, mentoring, investment facilitation, networking, or innovation ecosystem development

Capital Transfers Exempt from CIT

Income from transferring equity or shares in innovation startups is exempt from CIT.

Provided the underlying investee entity continues to meet the requirements innovation startups at the time of the transfer, then a disposal will be able to access the CIT exemption. However, sale of the entire capital in a limited liability company through a capital transfer involving real estate may result in tax based upon real estate transfers.

Personal Income TAX (PIT) Exemptions

Decree 20 introduces a number of incentives for individuals to invest in startups and innovation, or for experts to be incentivised and attracted to work for the long-term benefit of innovative enterprises.

1. Incentives for Experts and Scientists

Eligible experts and scientists working for innovative startups, R&D centers, or intermediary organizations are entitled to a PIT exemption for the first 2 years, followed by a 50% reduction for the next 4 years on wage / salary income earned.

The tax periods are calculated consecutively from the first month that qualifying income arises, providing a medium-term incentive for high-value human capital to join Vietnam’s innovation ecosystem.

2. Share/Capital Transfer PIT Exemptions

Individuals earning income from the transfer of shares, capital contributions, capital rights, share purchase rights or related rights in innovative startup enterprises are exempt from PIT on that income (with exclusions for public or listed securities interests).

This reduces the tax burden on early investors and founders, enhancing the financial attractiveness of startup investment.

Complementary Development Incentives

While tax incentives are central, Decree 20 operates as part of a broader ecosystem support package (often in concert with other legal instruments) including:

1. Access to Land & Infrastructure Support

The State is providing support for infrastructure investment in industrial parks and technology incubators. In addition, Infrastructure investors who reduce land rent for SMEs, high-tech enterprises, or startups can receive a refund or offset from the State budget.

Further, the Decree outlines procedures for businesses to rent state-owned houses and assets for production and business purposes at preferential rates or with simplified bidding procedures.

2. Science, Technology, and Human Resource Development

Enterprises can direct up to 20% of their taxable income into a Science and Technology Development Fund which they can establish. R&D expenses are eligible for deduction at a rate of 200% of the actual cost when determining taxable income. Therefore, when calculating CIT, the company can deduct not only the actual R&D expenses incurred but also an additional equivalent amount, bringing the total deduction to 200% of the actual R&D costs

The State is further providing free digital platforms and accounting software for micro/small enterprises and household businesses, with the State budget covers 100% of the costs for business management training courses (including accounting, tax, and human resources) for these enterprises and household businesses.

For further assistance, contact us at vietnam@alitium.com

This guide is intended as a general overview only and does not constitute legal or tax advice. Payroll outcomes may vary depending on individual circumstances, contractual structures, and regulatory interpretation. Employers should seek professional advice before relying on this information.