Establishing a Foreign-Owned Company in Vietnam in 2026

Vietnam Continues one of Southeast Asia’s most compelling investment destinations in 2026, supported by continued economic growth, a young workforce and deep integration into global supply chains. However, while market opportunities are significant, foreign investors must navigate a structured regulatory framework that requires careful planning and sequencing. Company incorporation alone does not determine successful market entry in Vietnam, as it depends on understanding market access rules, licensing requirements and post-establishment obligations from the outset.

Planning and Regulatory Understanding is Crucial

For foreign investors, early-stage planning is critical. Although many sectors in Vietnam are open to foreign investment, a number remain restricted or subject to specific conditions under Vietnam’s investment laws and international commitments. These conditions can affect ownership ratios, permitted business activities, licensing authorities and operational scope. Identifying applicable restrictions and structuring the investment correctly before submitting applications can significantly reduce delays, avoid rejections and prevent costly restructuring later.

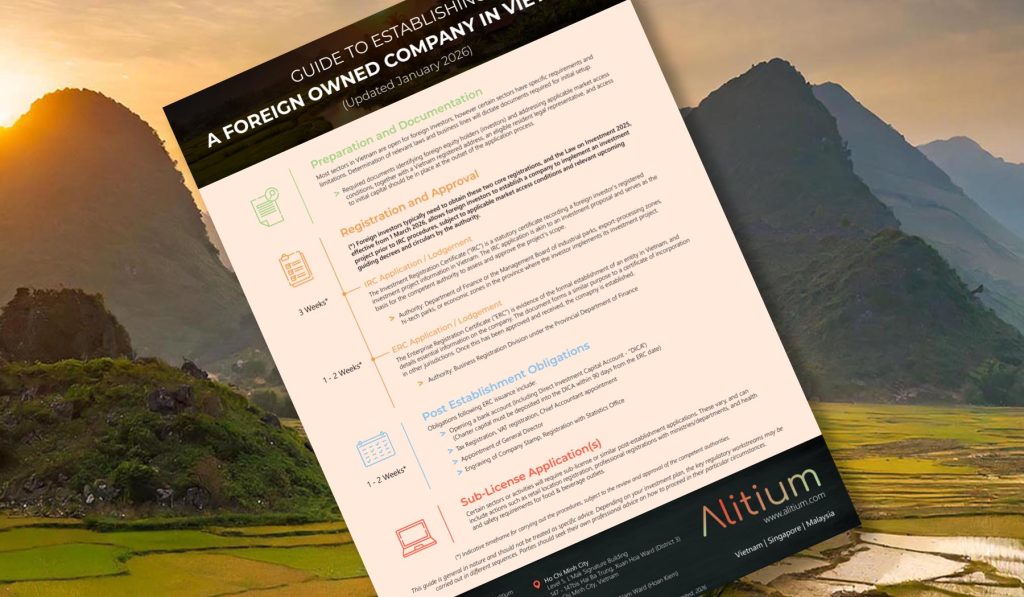

The Company Establishment Process in Vietnam

Foreign-owned company establishment in Vietnam typically involves two core registrations: the Investment Registration Certificate (IRC) and the Enterprise Registration Certificate (ERC). The IRC functions as an approved investment project, while the ERC formally establishes the legal entity. Depending on the sector, location and investor profile, these steps may be carried out sequentially or in parallel under updated investment regulations effective from 2026. Selecting the correct business lines, investment capital structure and legal representative at this stage is essential, as these details form the foundation for all future operations.

Post-Establishment Requirements and Ongoing Compliance

Once the company is established, foreign investors must complete a series of post-establishment obligations. These include opening statutory bank accounts (including a Direct Investment Capital Account), capital contribution within prescribed timelines, taxation and VAT registration, appointment of key management roles such as the General Director and Chief Accountant, and compliance with ongoing reporting obligations. These requirements are closely monitored by authorities, and non-compliance can result in penalties or operational disruption.

Sub-Licences and Regulated Activities

foreign-owned businesses in Vietnam may be required to obtain additional sub-licences after establishment, depending on their activities. These may include sector-specific approvals, retail location registrations, professional certifications, or health and safety licences. Investors should identify any regulated or conditional activities early in the planning phase and factor these into timelines and budgets. Understanding which activities require additional approvals, and which are prohibited, allows investors to structure their operations realistically and compliantly from day one.

Supporting Foreign Investors in Vietnam

At Alitium, we support foreign investors at every stage of their Vietnam market entry and operations. From investment structuring and licence assessment through to incorporation, post-establishment compliance and ongoing advisory support, our team helps investors navigate Vietnam’s regulatory environment with confidence. By combining local expertise with practical commercial insight, Alitium ensures your Vietnam investment is not only established correctly, but positioned for long-term success.

For further assistance, contact us at vietnam@alitium.com

This guide is intended as a general overview only and does not constitute legal or tax advice. Payroll outcomes may vary depending on individual circumstances, contractual structures, and regulatory interpretation. Employers should seek professional advice before relying on this information.